Memphis Mayor’s 75-Cent Tax Increase Proposal: A bold Move Towards Real Budget Reform

In a bold and unconventional move, Mayor Paul Young of Memphis has proposed a 75-cent tax increase in his first budget request. The request, a cornerstone of his presentation to the council after celebrating 100 days in office, elucidates a simple but alarming fact that Memphis can no longer underfund its crucial city services or neglect the improvement of core neighborhoods and residents’ well-being. The current continued under-investment, especially in the face of public demands, endangers the aimed goals of fiscal responsibility and improved public services.

Mayor Young’s audacious proposal doesn’t play into the familiar chorus of “balancing the budget without a tax increase” or “improving efficiency.” Instead, it raises a stark red flag indicating the inadequacy of status quo budgets in meeting the aspirations of Memphis’ citizens.

Most mayors find it easier to resort to small, incremental tax increases. It causes less public angst and allows taxpayers to plan for these incremental increases. Ignoring such a stance, however, led to an underfunded budget, which has now been inherited by Mayor Young from his predecessor.

Mayor Young’s Proposed Budgetary Options

Mayor Young presented three budgetary options – a status quo budget, a middle ground budget funded by a 50-cent tax increase that offers $26 million in new spending, and his preferred budget – the 75-cent tax increase. This proposed increase aims at funding increased litter cleanup and street maintenance, $8 million for Memphis Area Transit Authority, $5 million for parks programming and youth initiatives, and $2 million for early childhood care. Considering these options, the 75-cent proposal seems to be an ambitious long shot.

Setting the Stage for a New Era

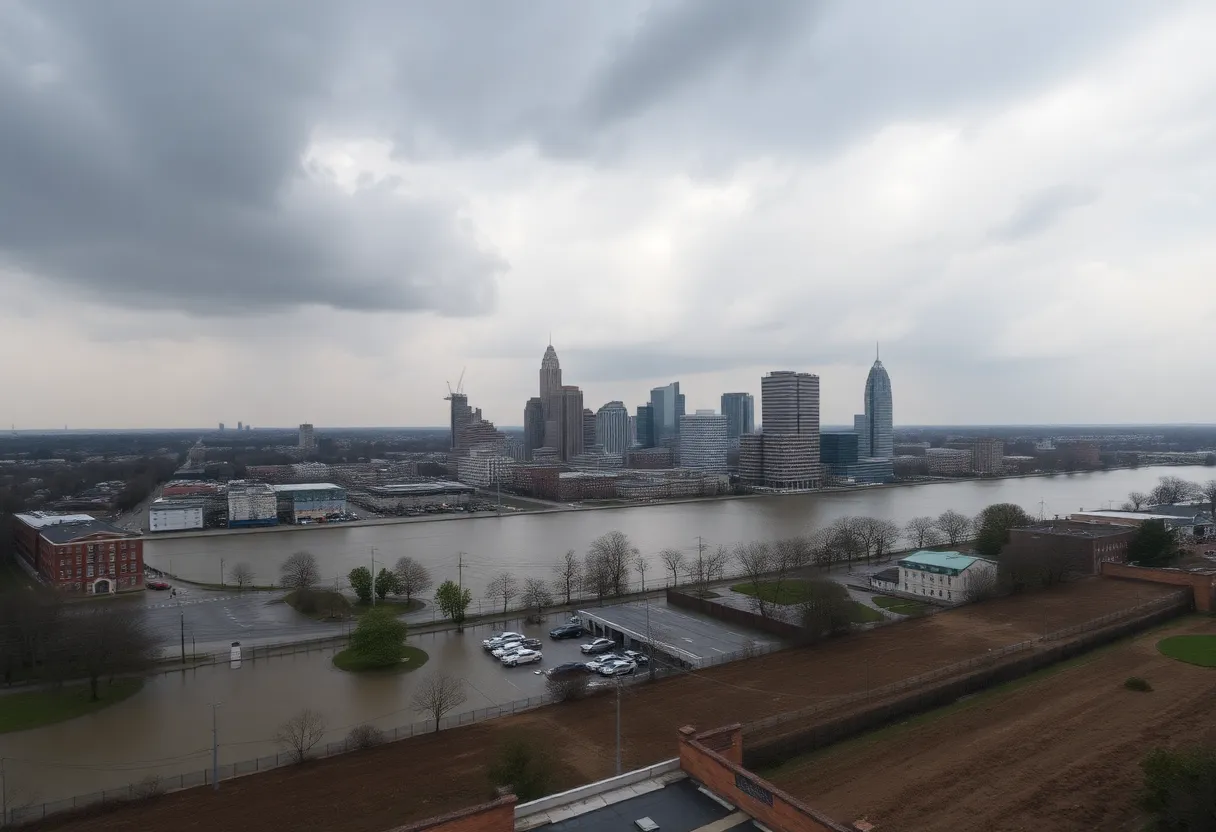

The Mayor’s budget presentation was compelling. It efficiently utilized visual aids, decorative graphics, and charts to feed the data-hungry audience and kept them engaged.

Substantively speaking, the presentation was slightly skewed, focusing majorly on the Capital Improvements Project budget rather than the operating budget that largely influences the tax rate.

In recent years, City Council budget hearings were often a non-event with minimal hard questioning from council members. This year, however, things are set to change. The council members are expected to dig deeper into the budget proposal and challenge its underlying assumptions and expectations. This augurs well for the necessary transparency in government functioning.

The Challenge Ahead: Balancing Citizens’ Budgets

However, convincing Council members to approve the highest property tax rate in over four decades will not be an easy task. Against this backdrop of the proposed tax increase, many citizens are concerned about the burden it will add to the higher bills following property reappraisals, county government’s $25 wheel tax increase, a 12% rise in the MLGW rate approved by City Council, and the 19.8% inflation in the past five years.

Despite these concerns, the Young Administration, along with the Memphis City Council, face a tough task of making the right decisions for the city’s future. Encouraging citizens to understand the municipal budget processes and trade-offs involved in budgetary decisions is going to be a key strategy to foster an understanding and acceptance for the changes proposed.

At the end of the day, it would be essential to remember that the City of Memphis budget signifies more than just financial allocations. It is a reflection of the city government’s values and principles. Therefore, it is crucial for the Young Administration, City Council members, and every Memphis citizen to strive towards developing a responsible, responsive, and inclusive budget.